Warren Buffet once said that the average investor should put his money in a broad S&P index fund. I agree. But we need to give that some context because not all investors have the same time-frame and therefore their investment portfolios should be different.

What is an investment portfolio?

An investment portfolio is a basket of assets that can hold many types of assets such as stocks, bonds, mutual funds, real estate, cryptocurrencies and many others.

Diversification and allocation

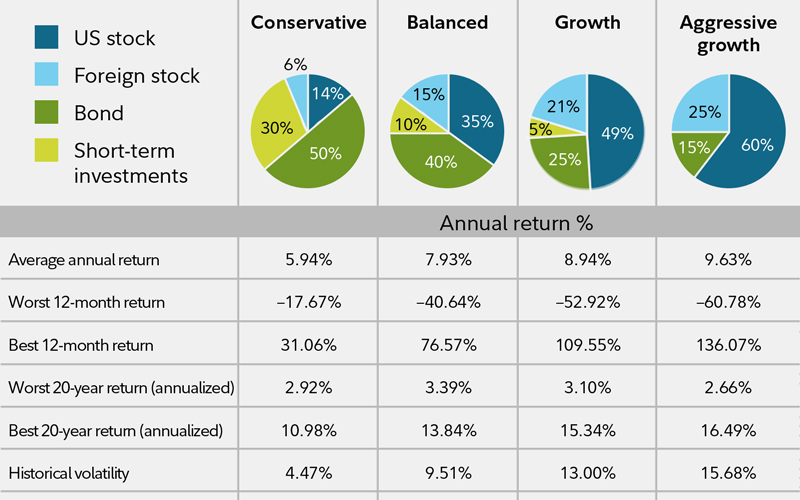

Creating an investment portfolio starts with deciding your target allocation. The statement from Warren Buffet refers to investors with a long horizon, maybe people in their 30s saving for retirement. In that case i might agree it’s a good strategy to put it all on stocks. But if your are in your 60s, allocating 100% to stocks would be very risky!

The general rule of thumb is invest your age as a percentage in bonds. For example if you are 45 years old, allocate 45% to bonds and 55% to stocks.

It’s not a perfect strategy but it’s the best one i can come up with without knowing more details from you. And if you decide on this approach you can’t go wrong.

Personally i like to set aside 5 to 10% for speculation. In my case it’s currently cryptocurrencies but others might prefer gold.

My portfolio

As an example, i’m a 38 year old saving for retirement and my portfolio revolves around these assets:

- Lyxor Euro MTS all maturity

- ishares US 1-3 euro hedged

- SPDR MSCI Europe Small Cap Value

- Berkshire Hathaway

- iShares core MSCI europe

- iShares edge msci world value

- iShares Emerging markets UCITS

- iShares MSCI core Japan

- iShares core FTSE 100 UCITS

- Cryptocurrencies

Each part is currently around 10%.

Don’t waste too much energy thinking about if you should increase or decrease the US or Japan allocation or whatever. It’s not that important in the long run as long as you are well diversified.

Other investment ideas

Cryptocurrencies

Personally i like cryptos. Cryptocurrencies are here to stay but that doesn’t mean they are a sure thing. There are literally thousands at this point and picking the winners will be very unlikely but i’m into tech and it’s kind of a hobby. Being rational about it i understand that the odds are against me.

Read also: Crypto portoflios.

Real estate

Some people feel more comfortable investing in real estate because it feels more palpable. I understand that and i see potential in it. But keep in mind that real estate is considered to be more risky than stocks!

Emerging markets

The world is becoming more and more globalized and i expect many countries to move out of poverty in the next few decades. Investing only in emerging markets for their potential growth isn’t sensible but investing in the developed world only isn’t sensible either!

Wrapping it up

There are no two equal Investment portfolios. It all comes down to personal preference and personal situation. Remember that the most important is to diversify. The more diversified you are, the less likely you are to make mistakes.

1 thought on “Investment Portfolios and diversification ideas”

Comments are closed.