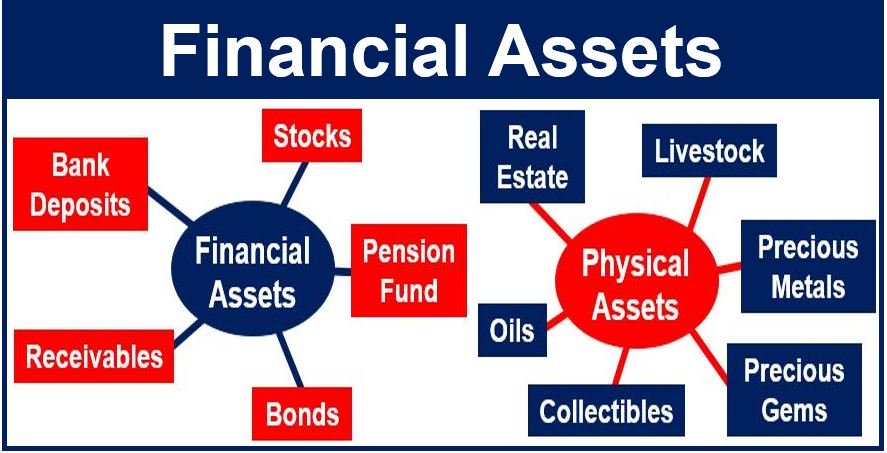

There are many types of financial assets and understanding them all can seem daunting to new investors. That’s we’re going to define the most common and basic types of assets. If you understand these simple terms you are already ahead of the game.

Stocks

A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation. This entitles the owner of the stock to a proportion of the corporation’s assets and profits equal to how much stock they own. Units of stock are called “shares.”

Buying stocks of a company means you are actually becoming one the many owners of that company.

Read also: What is an IPO (initial public offering).

Bonds

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments.

Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer.

Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually includes the terms for variable or fixed interest payments made by the borrower.

In simple terms, when you buy a bond from a company or government it’s like you a lending money to that company or government.

Mutual Funds

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds, and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund. Mutual funds invest in a vast number of securities, and performance is usually tracked as the change in the total market cap of the fund—derived by the aggregating performance of the underlying investments.

Index funds

An index fund is a subset of mutual funds but with a small difference. They are not actively managed. This means that there is no manager picking stocks for the fund, instead, the fund has all the stocks of the index.

Exchange traded funds (etfs)

An etf is also a subset of the mutual funds with a particularity, you can trade them as if they were stocks. There are actively managed etfs but the majority of them are like index funds.

Commodities

A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Commodities are most often used as inputs in the production of other goods or services. The quality of a given commodity may differ slightly, but it is essentially uniform across producers.

Commodities produce no income by themselves. Good examples of commodities are gold, silver, oil, cryptocurrencies and livestock.

Cryptocurrencies

Cryptocurrencies can be seen as currencies or commodities. They are speculative digital assets.

Real estate

Real estate is the land along with any permanent improvements attached to the land, whether natural or man-made—including water, trees, minerals, buildings, homes, fences, and bridges. Real estate is a form of real property. It differs from personal property, which are things not permanently attached to the land, such as vehicles, boats, jewelry, furniture, and farm equipment.

You can invest in real estate directly or via mutual funds.

Choosing the appropriate assets to invest

A diversified portfolio should have at least a component of stocks and one of bonds.

The general rule of thumb is the more diversified is your portfolio, the less riskier it is. Having several types of assets in your portfolio can help protect you from serious mistakes.

Read also: Investment portfolios and Investing for beginners.